Can Debt Consolidation be a Remedy that your Family Benefits from? We are just coming out from the pandemic and your Family’s Heath will be top of mind for you. Many families are also dealing with their Financial Health and Debt Consolidation as a possible method to manage their debt. There’s no way around it, […]

Continue ReadingLife Insurance for Families

Guest Feature by: Peter Morgan Balancing the demands of a busy life – the family, the job, the house – is already a challenge. When you add shopping for life insurance to the list, it can be overwhelming. We can help. At Co-operators, we’re committed to delivering straightforward advice and solutions, making it easy for […]

Continue ReadingInterest Rates in Canada Unlikely to Come Down

SUPRISE, SURPRISE; Media and Financial Markets are getting ahead of themselves! We are sure it will be no SURPRISE that after the last interest rate hike in January, the financial markets — and especially the media — have gotten ahead of themselves going so far as to say we would see a rate decrease in […]

Continue ReadingRelief for the Distressed Borrower

Distressed over Finances? We are here to help! Are expenses starting to rule your life? How are other Canadian families making ends meet as the world settles back into “normal”? The lingering impacts of the pandemic, a volatile housing market and rising inflation rates have left many struggling to catch up. From what we’ve […]

Continue ReadingMarket Update 2023 — Interest Rate Projection & More

Inflation, Interest Rates, Real Estate and Financial Markets …. What is on the Horizon for 2023? Many of our Clients and the General Public are Asking what will happen to interest Rates and the Housing Market in 2023. First off, our reference rate for variable rates is the Canadian Bank Prime Rate at 6.45% […]

Continue Reading2022 Holiday Community Charity Guide

Your Guide to Great Local Charities: Looking for a way to give back this holiday season? There are so many wonderful charitable organizations in Simcoe, Grey and Bruce Counties, it can be hard to pick who to support! To help, we’d like to take this opportunity to share some of our favourite local charities that […]

Continue ReadingCanadian Home Sales Show First Promise of Hope

Exciting news — we are encouraged to share the first glimmer of hope in the Real Estate Market as home sales increase, inflation relaxes and increased global diplomacy takes effect. We are not out of the woods yet; however, we are seeing some light peering through the trees. The Canadian Real Estate Association (CREA) show […]

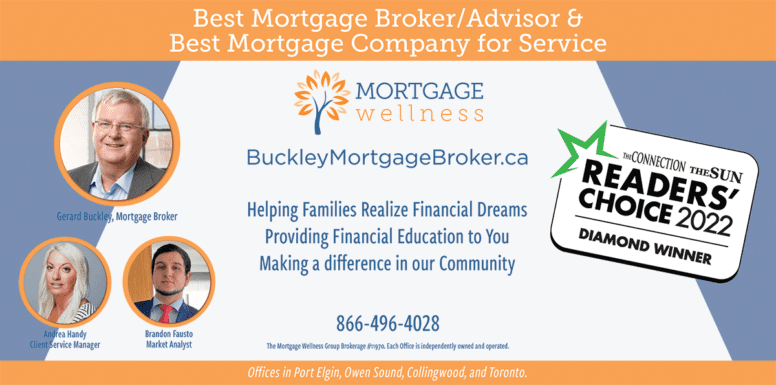

Continue ReadingPress Release: Buckley Mortgage Broker Wins 2 Readers Choice Awards

Press Release: Gerard Buckley of Buckley Mortgage Broker Wins Two Categories in the 2022 Connection & Sun Readers’ Choice Awards For Release October 20, 2022 Seasoned Professional Gerard Buckley takes home two Reader’s Choice service recognition awards in the categories of Best Mortgage Broker/Advisor and Best Mortgage Company for Service in Georgian Bay. […]

Continue ReadingMortgage Broker Trends for the Second Half of 2022 | Zolo

GUEST FEATURE by Brandon Fausto – Financial Analyst at Buckley Mortgage Broker With an environment that has seen a large change in real estate pricing and mortgage rates, what might buyers see in the second half of 2022? Here’s what an Ontario-based mortgage broker has to say. First Off, Let’s Recap At the beginning […]

Continue ReadingWhat Will Happen to My Mortgage Payment: The Rise of Canadian Interest Rates

Mortgage payments up 45%! Interest rate surge is going to hurt! Anxiety and confusion increasing! One look at the top financial headlines and it’s no wonder you’re worried about your mortgage payments. Perhaps you’re fixed in and your term is about to come up for renewal. Or, maybe, you’re in a variable mortgage and the […]

Continue Reading