SUPRISE, SURPRISE; Media and Financial Markets are getting ahead of themselves!

We are sure it will be no SURPRISE that after the last interest rate hike in January, the financial markets — and especially the media — have gotten ahead of themselves going so far as to say we would see a rate decrease in Canada before the end of 2023.

Conferring with my Bond Trading friends over lunch on Friday this is not to be the case. (Shout out to the Excellent Smoked Meat Sandwich at TheSmoke.ca in Collingwood)

We are still holding our view published on January 24th in an article titled: Inflation, Interest Rates, Real Estate and Financial Markets ….. What is on the Horizon for 2023? Where we spoke of the Canadian Prime Rate getting to 7.00 to 7.25% from the current 6.70% and not anticipating an interest rate reduction until at least the first quarter or mid-2024. We also feel, although not to previous levels seen in pre-pandemic, we will see housing sales come back by May or June 2024 for the reasons cited of pent-up demand and immigration.

Although we don’t anticipate an increase in interest rates on March 8, we could see another 25 to 50 points increase this year.

Fixed Interest Rates moved higher again on Friday because of 5-year Canadian Bonds moving to 3.68% this week a level closer to the 2022 highs of 3.98% up from the lower levels of 2.82% seen in the latter part of January this year. This is due to reacting to the market south of us and continued inflation.

We are still experiencing an inverted yield curve, which, for the average person means that 1-year rates are higher than 5-year rates.

For a purchase, 1 year is 5.99%, 3 year is 4.99% and 5 year is 4.79%.

For refinancing, 1 year is 5.85%, 3 year is 5.34% and 5 year is 5.24%

We are not done with inflation in Canada. Although Core Inflation in Canada was 4.95% in January, this is not what the average person sees. What families in Canada are seeing is 10% plus in food inflation, energy prices rising 4.7% month over month and shelter prices rising to 21.2%. Headline inflation of 5.9% in January down from 6.3% in December does not tell the true story of the cost of living for the average Canadian.

Corporate “Greedflation” has seen price increases for food items on a quarterly or semi-annual basis where previous increases occurred every three years or more as Peter Neal of Neal Brothers Contributed. This has resulted from supply-side shocks and robust consumer demand.

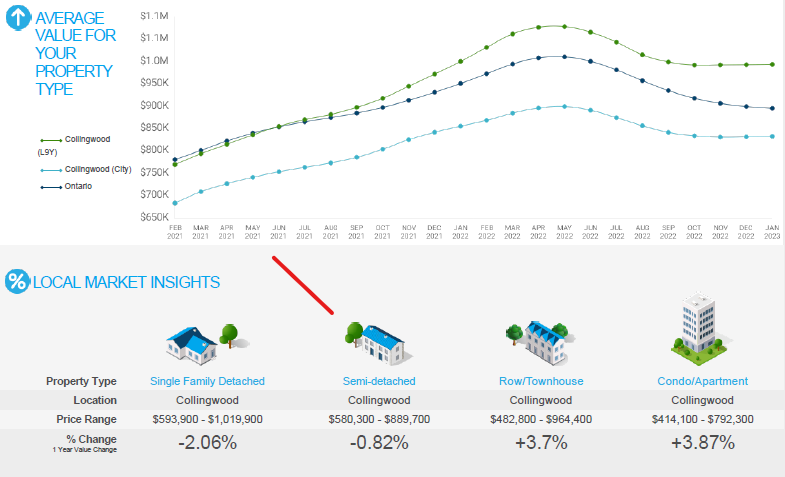

For Housing Sales, we hold our view of January 2023 that this spring we will see buying activity return; however, it will be much slower than pre-pandemic levels. This week in the Collingwood Area we have seen some slight price increases. See the above graph.

Toronto home sales were down 44% in Jan ’23 from ’22; however, in Georgian Bay, we are not experiencing the same degree of change. Notwithstanding, First Time Home Buyers have been squeezed out of the housing market due to the current interest rates. It is not lost on us that in 2022 a total of 43% of realtors did no transactions.

Most of our clients are renewing for three-year terms. Many Mortgage Borrowers are experiencing tighter lending conditions from banks and other Lenders as this week many banks have announced further Loan Loss Provisions with their quarterly earnings results.

Mortgage activity was up in early January, and it has petered out in the last two weeks with higher fixed rates on the horizon. Last week we were offering 4.69% as a 5 Year Fixed Rate for insurable rates and for the most part, these rates have increased to the 5% range. Notwithstanding RBC saw a 40% decline in mortgage originations in the first quarter, ending Jan 31st.

The Canadian Bank Regulator, OSFI’s consultation will end around the middle of April and we see further tighter lending conditions this year.

Though the risk of a recession is still with us the forecast of a soft landing is far from certain.

How we work has changed and many maintain a requirement to work from home. This is supported by Royal Bank’s CEO Dave McKay’s comments this past Thursday in the Globe and Mail where he says, “workers and bank employees continue to work from home”. This has benefited recreational areas such as Georgian Bay with skiing, biking, golfing, boating, etc. in abundance.

In summary, interest rates and stock markets remain uncertain. The USA is still poised for rate increases and inflation will persist into Mid – 2023 as demonstrated by food and energy inflation as well as Fixed Interest Rates remaining firm and supported by the Federal Reserve in the USA being much more Hawkish in the last two weeks.

We will continue to watch inflation (food, energy and headline — not core inflation) and job creation numbers both in Canada and the USA for signs of interest rate changes and a pending recession.

Real Estate Spring Market will return; however, not to past levels.

Buckley Mortgage Broker can assist you with your Mortgage Options

Our team offers decades of experience in assisting clients with financial needs. We provide creative solutions to debt and financing problems with access to more than 70 lenders. Ready to take control of your finances? Give us a call or send us an email today.