Higher Prices for Everything There is no shortage of people discussing whether we have or do not have inflation. What we do have are higher prices than we had 1, 2, 3 or 5 years ago. We have higher prices for everything from food, energy and consumer goods to housing costs, taxes, and development charges. […]

Continue ReadingUnderstanding Housing Affordability in 2024

Posted on by Gerard Buckley

Housing affordability is a hot topic in 2024, and there’s a lot of talk about how interest rates affect it. Too many people are drinking the “lower interest rate Kool-Aid” as the route to housing affordability. While many people think lowering interest rates is the key, we at Buckley Mortgage Broker Team believe they won’t […]

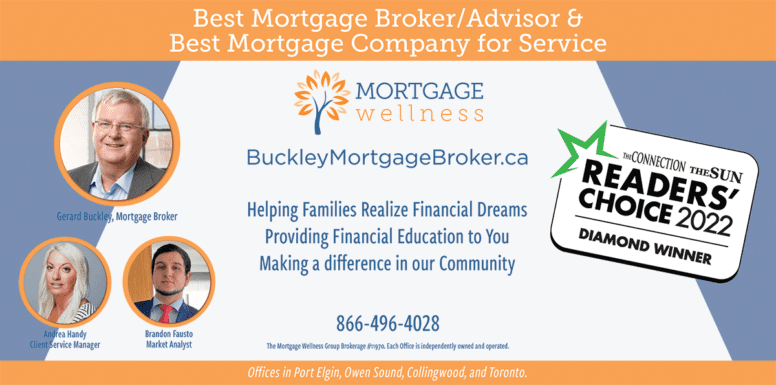

Continue ReadingPress Release: Buckley Mortgage Broker Wins 2 Readers Choice Awards

Posted on by Gerard Buckley

Press Release: Gerard Buckley of Buckley Mortgage Broker Wins Two Categories in the 2022 Connection & Sun Readers’ Choice Awards For Release October 20, 2022 Seasoned Professional Gerard Buckley takes home two Reader’s Choice service recognition awards in the categories of Best Mortgage Broker/Advisor and Best Mortgage Company for Service in Georgian Bay. […]

Continue Reading