FOR IMMEDIATE RELEASE Buckley Mortgage Broker – Mortgage Wellness awards Advanced Aquatics Scholarships and Investing in Futures Scholarships for YMCA Youth Collingwood & Wasaga Beach, Ontario – July 8, 2024, | Gerard Buckley and Mary MacDonald, long-time supporters of the Collingwood and Wasaga Beach YMCAs, have once again demonstrated their commitment to the community by […]

Continue ReadingJune Housing Market Update for Ontario

Higher Prices for Everything There is no shortage of people discussing whether we have or do not have inflation. What we do have are higher prices than we had 1, 2, 3 or 5 years ago. We have higher prices for everything from food, energy and consumer goods to housing costs, taxes, and development charges. […]

Continue ReadingUnderstanding Housing Affordability in 2024

Housing affordability is a hot topic in 2024, and there’s a lot of talk about how interest rates affect it. Too many people are drinking the “lower interest rate Kool-Aid” as the route to housing affordability. While many people think lowering interest rates is the key, we at Buckley Mortgage Broker Team believe they won’t […]

Continue ReadingFirst Home Savings Account – Should You Set One Up?

All first-time homebuyers take note: we want to tell you about the First Home Savings Account (FHSA) again because it’s a great way to save money for your first home. But what exactly is it? The FHSA is a special savings account created by the government to help people who want to buy their first […]

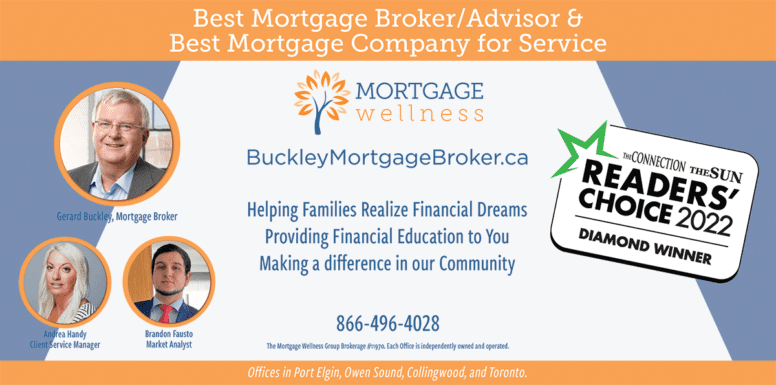

Continue ReadingBuckley Mortgage Broker Takes Home Readers Choice Awards

For Release October 12, 2023 Buckley Mortgage Broker of Mortgage Wellness, a leading mortgage broker team in Georgian Bay, is proud to announce that they have been honoured with the prestigious Readers’ Choice Awards for Best Mortgage Company for Service in Georgian Bay & Best Mortgage Broker/Advisor 2023 – marking their second consecutive win of […]

Continue ReadingSelf-Employed Mortgage in Ontario

Self Employed? We have you Covered. If you are a self-employed person in Ontario, this article is for you. Are you looking to get a mortgage to purchase a home or to refinance your current home but don’t know where to start? Let us help you. “What is a self-employed mortgage?”, you might ask. […]

Continue ReadingRelief for the Distressed Borrower

Distressed over Finances? We are here to help! Are expenses starting to rule your life? How are other Canadian families making ends meet as the world settles back into “normal”? The lingering impacts of the pandemic, a volatile housing market and rising inflation rates have left many struggling to catch up. From what we’ve […]

Continue ReadingPress Release: Buckley Mortgage Broker Wins 2 Readers Choice Awards

Press Release: Gerard Buckley of Buckley Mortgage Broker Wins Two Categories in the 2022 Connection & Sun Readers’ Choice Awards For Release October 20, 2022 Seasoned Professional Gerard Buckley takes home two Reader’s Choice service recognition awards in the categories of Best Mortgage Broker/Advisor and Best Mortgage Company for Service in Georgian Bay. […]

Continue ReadingMortgage Broker Trends for the Second Half of 2022 | Zolo

GUEST FEATURE by Brandon Fausto – Financial Analyst at Buckley Mortgage Broker With an environment that has seen a large change in real estate pricing and mortgage rates, what might buyers see in the second half of 2022? Here’s what an Ontario-based mortgage broker has to say. First Off, Let’s Recap At the beginning […]

Continue ReadingWhat Will Happen to My Mortgage Payment: The Rise of Canadian Interest Rates

Mortgage payments up 45%! Interest rate surge is going to hurt! Anxiety and confusion increasing! One look at the top financial headlines and it’s no wonder you’re worried about your mortgage payments. Perhaps you’re fixed in and your term is about to come up for renewal. Or, maybe, you’re in a variable mortgage and the […]

Continue Reading