Building a custom new home in 2024? Let us guide you through the ins and outs of a construction mortgage So – you’re building a home in 2024, “Year of the High-Interest Rate.” Your dreams are big, and for that, we salute you. While it may not be the easiest time to build in Ontario’s […]

Continue ReadingInterest Rates in Canada Unlikely to Come Down

SUPRISE, SURPRISE; Media and Financial Markets are getting ahead of themselves! We are sure it will be no SURPRISE that after the last interest rate hike in January, the financial markets — and especially the media — have gotten ahead of themselves going so far as to say we would see a rate decrease in […]

Continue ReadingCOVID-19 REAL ESTATE MARKET CHECK-IN — Where Ontario Housing Trends are Headed in 2021

Continuing Lockdowns Push Urban Dwellers Out It’s an unprecedented time in Ontario’s real estate market. While some parts of the province are seeing development halts and pivots, other parts are exploding at rates nearly impossible to keep up with. So what do we see changing as 2021 sits just around the corner? Read on to […]

Continue ReadingBuckley Mortgage Team Formation Serving Simcoe, Grey and Bruce Counties

FOR IMMEDIATE RELEASE DECEMBER 1ST, 2020 Gerard Buckley, info@buckleymortgageteam.ca, 1-866-496-4028 Gerard Buckley, a local Licenced Mortgage Broker, and Verico The Mortgage Wellness Group Limited would like to announce the formation of Buckley Mortgage Team powered by Verico The Mortgage Wellness Group with offices in Collingwood, Owen Sound, Port Elgin and Toronto serving Simcoe, Grey […]

Continue ReadingMarketplace Update During COVID-19

Understanding the Current Marketplace Let me begin with my heartfelt hope that this letter finds you and your loved ones in good health. I wanted to reach out with some words of reassurance. In short…I’m here. We are in uncharted territory, and the mortgage marketplace in Southern Ontario is continually shifting to keep pace with […]

Continue ReadingAutomating the Mortgage Process

Serving Clients Better with Online Options Millennials — followed closely by the Z or iPhone Generation — may be known as the digital generation, however, both Boomers and Generation X are just as focused on finding ways to save time. Research shows that most age groups are prepared to complete their Mortgage Application online and […]

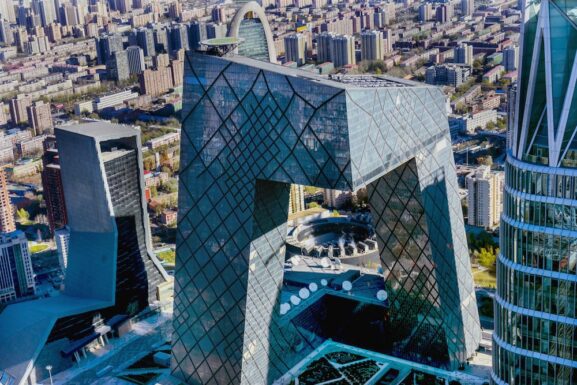

Continue ReadingCommercial Financing

The booming Canadian real estate market poses both opportunities and challenges for businesses all over the province of Ontario. If you are a company looking to acquire commercial financing in Toronto, Barrie, Kitchener, Ajax and other, the benefits and the costs of getting or developing properties must be weighed. Having an in-depth understanding of each […]

Continue ReadingTop 5 Tips and Tricks for new home mortgages for Millennials

The trajectory of Millennial home purchases is significantly growing. Millennial home buying purchase power now boasts the largest share of new home loans by dollar value as per realtor.com® analysis of residential mortgage loan originations, larger than both Generation X and the baby boomers. With that being said, Millennials are making lower down payments and […]

Continue ReadingHow do you Finance the Construction of a New Home?

Why try to buy your dream home when you can build it for yourself with the help of a Reputable Home Builder, Quality Architect, and Knowledgeable Mortgage Broker? Building your own home is possible with a residential construction mortgage, however there is much to understand before you jump in and get started. The Building Process […]

Continue ReadingHow to Budget for a New Home Purchase?

New Home Purchase: Hidden Costs of Budgeting Whether you are a Boomer, Millennial, Gen Z, Parent or Young Person settling down, buying a home is the single most expensive purchase you will make. This event stresses many young people and parents alike. When financing your first home purchase, you must make sure you understand the process […]

Continue Reading