New Home Purchase: Hidden Costs of Budgeting

Whether you are a Boomer, Millennial, Gen Z, Parent or Young Person settling down, buying a home is the single most expensive purchase you will  make. This event stresses many young people and parents alike. When financing your first home purchase, you must make sure you understand the process and have someone on your side with experience. Many first-time home buyers are often shocked while sitting with their lawyer when they see the total amount they have to pay on closing day.

make. This event stresses many young people and parents alike. When financing your first home purchase, you must make sure you understand the process and have someone on your side with experience. Many first-time home buyers are often shocked while sitting with their lawyer when they see the total amount they have to pay on closing day.

As homes are expensive compared to other purchases, they typically need a mortgage. Acquiring mortgages can be much more complex than you think, especially when it is your first time. Therefore, it is imperative that homeowners build and understand their budget, understand their financing alternatives, and have someone in their corner to help them get the best financing for themselves and family.

Budgeting at every stage in the homebuying process will ensure financial security and peace of mind.

Preparing Your Budget

Preparing Your Budget

When you begin the planning phase of your budget, it is important to figure out how much you are currently spending each month on household expenses (e.g. groceries, clothing, tuition), entertainment expenses (e.g. dining out, hobbies, travel), your current loans and debts, and savings accounts. Once you have this number, deduct it from your monthly income after tax to determine how much room you have for mortgage payments. As for the mortgage payments themselves, a great rule to go by is that you should never have your mortgage payments (principal and interest), property taxes, and heating bill be more than 38% of your monthly pre-tax income.

Additionally, keep in mind that if your total monthly debt payments (mortgage, credit card loans, auto-loans, etc.) are going to be more than 44% of your monthly gross income, you may have trouble qualifying for a mortgage. See to the left for the most common expenses for new homeowners.

Financing Your Home

The price of a home you can afford depends on your down payment, budget, mortgage rates, and the mortgage amount you qualify for. This is the time to consult with your mortgage broker to see what financing options are best for you. It is advisable to borrow less than the maximum mortgage you qualify for, as it allows you some breathing room in the case of unexpected financial distress. Getting a proper pre-approval for a mortgage will ensure you have a price range when looking at potential homes, allowing you to narrow your search down to certain home types and sizes.

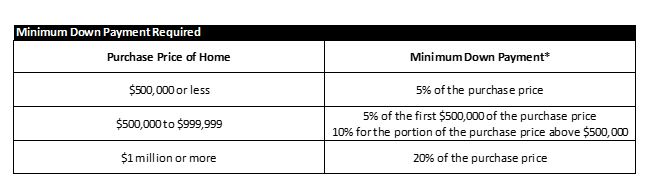

The minimum down payment is 5% for properties under $500k and 10% for the amount between $500 and 999K. Do not confuse the deposit paid to the realtor as the down payment. The deposit is a amount paid on the signing of the Purchase and Sale Agreement for which the selling realtor brokerage usually holds in trust. The amount usually ranges between $5,000 and $25,000 and often is a portion of the down payment. The deposit is often paid from your available cash resources and can not be drawn against a line of credit at closing.

One thing to keep in mind is to look out for rebates and incentives for first time homebuyers. For instance, First-time homebuyers in Ontario can qualify for a rebate equal to the full amount of their land transfer tax, up to a maximum of $4,000. Also, first time home buyers can use an RRSP to their advantage and certain communities have down payment assistance to apply for.

Maintaining Your Finances

The key to making your first home purchase financially is success is ensuring you are continuously considering your budget and staying within it. A mortgage is a long term commitment, which means you should stay aware of your current financial situation at all times. It is crucial that you make your mortgage payments on time, as missed or overdue payments can be detrimental to your credit score.

The key to making your first home purchase financially is success is ensuring you are continuously considering your budget and staying within it. A mortgage is a long term commitment, which means you should stay aware of your current financial situation at all times. It is crucial that you make your mortgage payments on time, as missed or overdue payments can be detrimental to your credit score.

When deciding whether you should make home improvements, you should always ensure whatever improvements you are thinking about will fit within your budget. It is a great idea to invest in the improvement in your home, but don’t get carried away with improvements unless you can afford it. Keep in mind that while the value of a home can be increased by improvements, it is not the only factor in determining a home’s price and can result in wasted money. Unless you plan to remain in your home for the long term, do not overinvest in home improvement.

Your budget is there to ensure you still are financially healthy, so it is important to live within your budget and leave a little extra for emergencies. Even with no emergencies, you will need additional funds for the unanticipated costs of operating a home. These costs may include property taxes, maintenance and repair, snow removal and gardening, among many others. Your mortgage broker should factor these added costs into your financial plan.

additional funds for the unanticipated costs of operating a home. These costs may include property taxes, maintenance and repair, snow removal and gardening, among many others. Your mortgage broker should factor these added costs into your financial plan.

Building and keeping a realistic budget will allow you to keep yourself and your family financially healthy, reducing stress and ensuring an enjoyable home ownership experience.

For a deeper look at Budgeting for a New Home Purchase, visit our blog at www.GerardBuckley.ca

Gerard Buckley, Mortgage Agent at Mortgage Wellness, has offices is in Collingwood, Owen Sound and Toronto with access to over 70 specialized lenders.

Please Call Gerard at 705-532-1182 for a Complimentary Review of our New Home Buyer’s Guide.