Rebuilding Credit in Ontario

Are you financially frustrated? That past credit mistake can continue to haunt you for many years. But rest assured — you are not alone and we would like to assist you (and possibly your family, as well) on the road to get your credit score back on track.

Whether you’re just beginning your journey in the world of credit or you’re trying to get back into it after unexpected financial trouble, raising your credit score is worth the effort. In Canada, higher credit scores allow people to qualify for larger lending amounts from financial institutions. Furthermore, a good credit score opens the door for lower interest rates. That can add up to thousands of saved dollars when dealing with long-term products like mortgages and home-equity lines of credit.

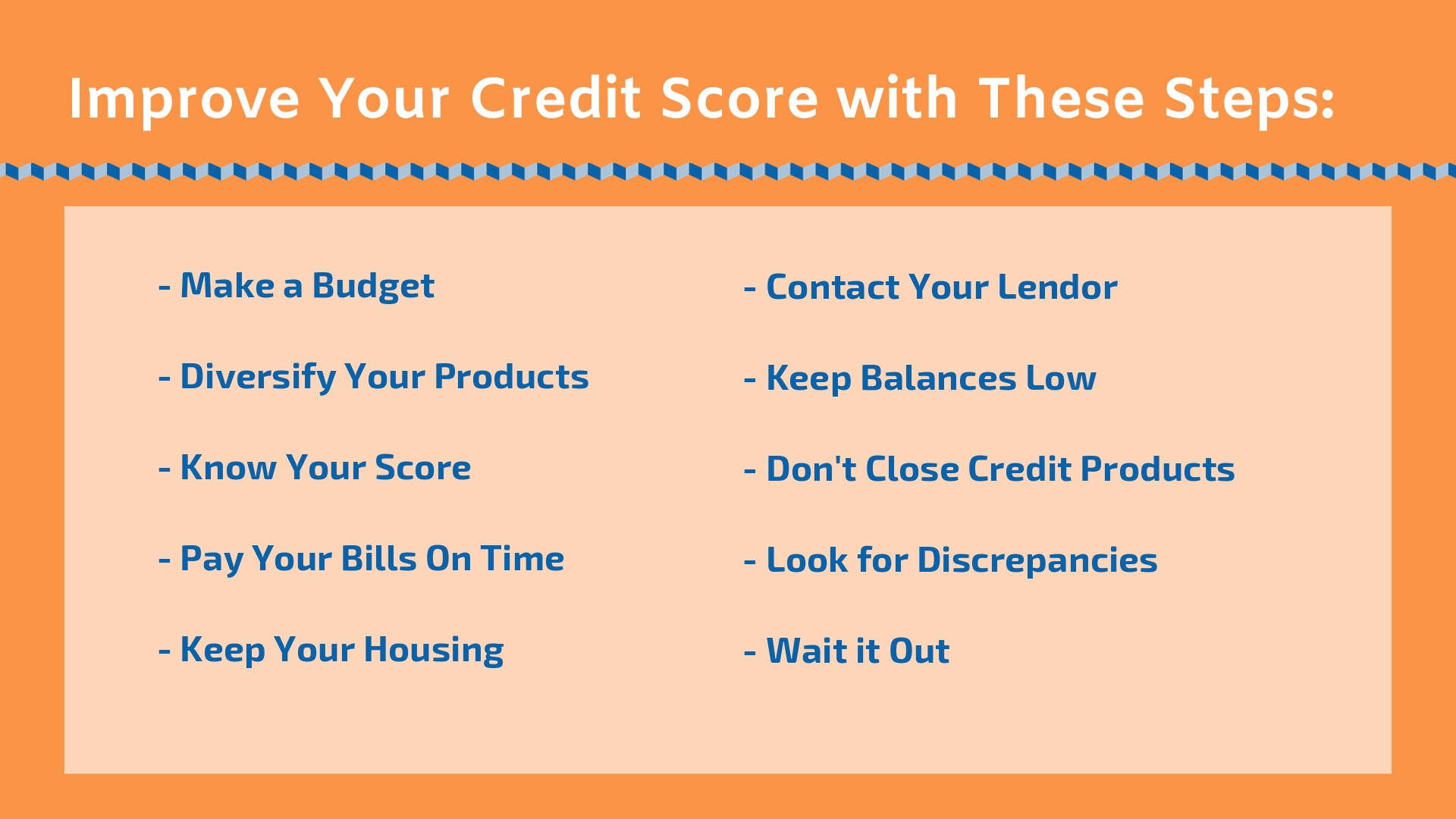

Do you have low or no credit? We’re going to walk you through the most effective ways to improve your credit score. Implement one or several of these solutions and watch how your score climbs back up into that healthy range.

#1 – Make a Budget

You can’t expect your financial situation to get better if you keep making the same credit mistakes. One way to ensure that all of your payments are being made each month is to sit down, total your monthly income and calculate your expenses. Some people are surprised to find out that they’ve been overspending on extra items. Become more strict with your money and you’ll be able to pay for important costs like loans and credit cards before dining out or online shopping.

#2 – Open Different Types of Credit

It may sound funny, but sometimes to get a better score, you need to borrow more. But we’re not advising to increase your credit card amount. Instead, take out a small loan to consolidate large credit card or line of credit balances. This will help your score to increase. Can’t qualify on your own? Speak to a trusted friend or family member about co-signing on your credit product to up the chances that you’ll be approved.

#3 – Check Your Credit the Smart Way

We have some news for you. In Ontario, your credit score takes a hit every time you apply for a new credit product or formally enquire about your score. Thankfully, credit reporting agencies such as Equifax and Trans Union allow you to check your credit score online or in writing for little or no cost without a credit check hit. When trying to acquire a new lending product, it’s best to limit the applications you fill out while comparing rates to a two week period so the enquiries are viewed as one product.

#4 – Pay Your Bills On Time

Letting a phone bill go past due every now and then may not seem like a big deal, but in the world of credit, late payments are bad news. Every time you let a payment go past 30 days, your credit score declines and a formal notation is made. These notices stay on your personal file for up to 7 years! If you have a habit of forgetting to pay any of your monthly bills, you could be sabotaging your chances of getting credit products in the future.

#5 – Try to Stay in One Place

Not only do credit applications affect your credit score — many rental applications count as a “hard hit” as well. If it is at all within your control, hold off of switching your housing situation while you’re focused on building credit. But don’t worry — once your credit is in a healthy range, an application every so often won’t majorly impact all of your hard work.

#6 – Don’t Be Afraid to Reach Out

Life happens and sometimes there aren’t enough finances to cover all of your monthly commitments. Some in this situation try to stay under the radar and attempt to make a payment later down the road when more money is available. Don’t do this! Contact your lender and discuss the issue — it’s a far better course of action. Provisions can be made that result in less negative credit score affects when customers and lenders work together.

#7 – Avoid Large Balances on Revolving Credit

Though it may not seem fair, lenders view you as a riskier investment if you tend to use more of your available credit. This includes balances left on credit cards and lines of credit — even if you’re making your minimum payments or paying off the balance each monthly entirely. The golden rule is to try to use only 35% of your available credit on any given month, only going over that when absolutely necessary. In addition, large unused credit limits can have a punitive effect. You are seen as riskier when you have large unused credit. Reduce the size of those large unused lines of credit. Separately, those large unused credit lines are often the target of fraudsters.

#8 – Leave Credit Products Open

Once again, this may not be what you expect, but credit companies don’t view it as a good thing when you close revolving credit products. Instead of closing credit cards that you’ve fully paid off, why not put the card in a secure place that is not on your person and view it as off-limits? On occasion, process a small charge through the card and pay it off in full to keep the account active. This will keep your score from taking any unneeded hits when you’re focusing on improving it.

#9 – If You See Something Weird, Speak Up

Credit scores are supposed to be linked to your specific social insurance number. However, some lenders use only your name when applying for a new product. While this may make the process go faster, it does leave room for error. If anyone else in Canada shares your name, it is possible that a credit product that is not yours can end up on your file. When applying for new credit, be sure to ask for details on any late payment reports that seem suspicious. Contact the reporting lender as soon as possible to resolve the infraction.

#10 – Be Patient

Having poor credit makes you feel stuck. While all of these steps may seem like they take a lot of time and work to execute, once you get on the right credit path, building good financial habits becomes easy. Not to mention, your future self will be so thankful while driving away in a new vehicle or purchasing a first home that you put in the work now.

Mortgage Options for All Credit

Looking to buy a property with less than perfect credit? Speak to Gerard Buckley, a Licenced Mortgage Agent with an A+ Better Business Bureau Customer Service Rating serving the Collingwood, Owen Sound, Saugeen Shores and Greater Toronto Area. Gerard’s vast experience in the financial world will help you make smart decisions when it comes to preparing for a home purchase.

Contact Gerard today and find out how you can have a healthy mortgage.